Keeping Protected With Mesa Car Insurance

Mesa may not be the most dangerous city in Arizona to drive in, but car insurance is still required.

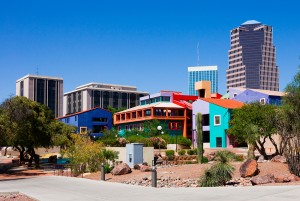

Safe driving and car insurance protection “straight ahead” in Mesa

Your chance of getting in a car accident in Mesa is considerably lower than it is compared to other larger cities in the state, but Arizona still says you have to have Mesa car insurance to drive. Besides, if you end up as one of the few car accidents that do happen in Mesa you will be very glad that you were required to have car insurance.

Mesa Car Accident Statistics

In 2012, Mesa had a total of 6,374 car accidents. Of those crashes, only 28 of them were fatal; meaning that 4/10ths of a percent of the car accidents in Mesa ended with someone dying. This puts Mesa in better standing than the State of Arizona as a whole in regards to fatal car accidents, as Arizona’s fatal car accidents accounted for 7/10ths of a percent of the 103,176 car accidents in the state in 2012.

Of Mesa’s 6,374 car accidents in 2012, there were 272 alcohol related accidents, 2,092 car accidents that had injuries, and 4,254 accidents that resulted in property damage only.

Comparatively, Mesa only accounted for 6/10ths of a percent of the total car accidents that happened in Arizona in 2012.

(Source:azdot.gov)

Mesa Car Insurance Requirements

Mesa car insurance requirements are the same as they are everywhere else in Arizona. It is not the City of Mesa that creates car insurance laws or tracks compliance, but they do still issue traffic citations if you are caught without the coverage.

To keep yourself free of a traffic citation in Mesa for not having car insurance, make sure that you are carrying the minimum required coverages. These coverages include:

$15,000 in liability coverage for the medical expenses of a single person (not in your vehicle) that you injure)

$30,000 in liability coverage for the medical expenses of 2 or more people that you injure

$10,000 in liability coverage that pays for the damages you cause to another person’s property that you cause with your vehicle.

Insurance agents in Arizona won’t sell you anything less than the above coverages, so it is unlikely you will get a citation for not having enough insurance. So you either have Mesa car insurance coverage and are driving legally, or you don’t have it at all and you are setting yourself up for future legal and financial problems.